- Blogs, News articles

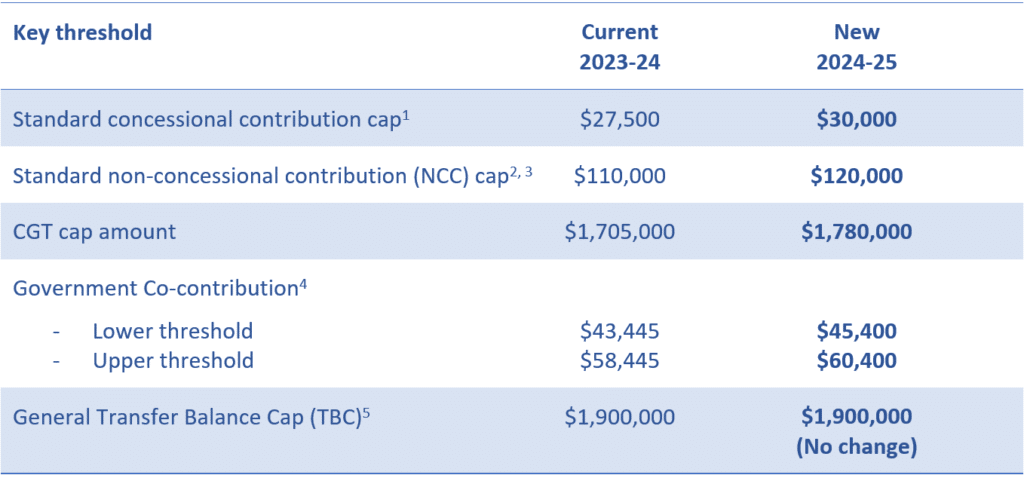

Each year, several key superannuation rates and thresholds are indexed in line with movements to Average Weekly Ordinary Time Earnings (AWOTE) or the Consumer Price Index (CPI).

Following the recent release of these key statistics by the Australian Bureau of Statistics (ABS), the ATO has officially released the updated superannuation thresholds for 2024-25.

These thresholds are set out in the table below:

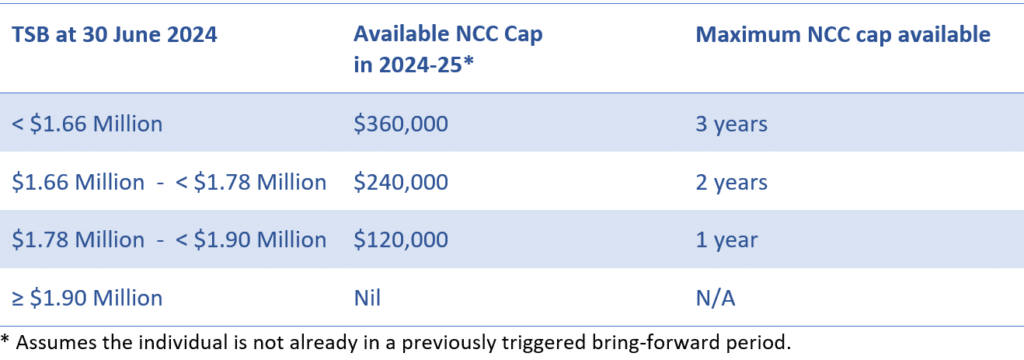

Based on an individual’s Total Superannuation Balance (TSB), as measured on 30 June 2024, an individual under the age of 75 on 1 July 2024, may be able to trigger a bring-forward period permitting an increased NCC amount to be made during the 2024-25 financial year, as follows:

Notes:

1 An individual’s personal concessional contribution cap for 2024-25 may be higher if they’re eligible to unlock unused carried forward concessional contribution cap amounts from previous years.

2 Individuals who are already in a previously triggered bring-forward period will not benefit from the increase in the

Non-concessional contribution cap. Their Non-concessional contribution cap for 2024-25 will be limited to the amount previously locked in.

3 An individual’s NCC cap in 2024-25 will be NIL where their TSB, measured on 30 June 2024 is $1.9 Million or more. This also applies to individuals who are already in a previously triggered bring-forward period.

4 An individual’s TSB must be less than $1.9 Million to be eligible for a Government Co-contribution.

5 An individual’s Personal Transfer Balance Cap will be less than $1.9 Million where they commenced a retirement phase income stream before 1 July 2023.

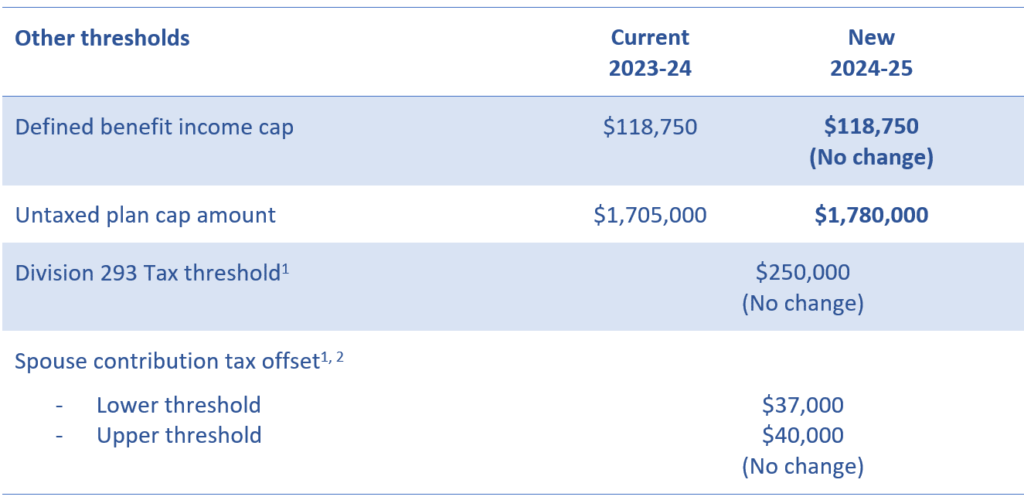

Other relevant caps and thresholds

The following thresholds are also likely to be of interest to SMSF practitioners:

1 These thresholds are not subject to CPI / AWOTE indexation. 2024-25 threshold is indicative only.

2 The TSB (of the spouse receiving the contribution) must be less than $1.9 Million to be eligible for the spouse

contribution tax offset.

Other reminders

From 1 July 2024:

- Preservation age will increase to age 60 (i.e. those born on or after 1 July 1964).

- The low-rate cap on superannuation withdrawals becomes irrelevant as individuals will no longer be able to make a superannuation withdrawal between preservation age and under age 60.

- The SG rate will increase from 11% to 11.5%.

Written by Fabian Bussoletti, Technical Manager